| Identification FastTab |

|

|

| Identification |

|

|

| EDI number |

EDI Staging table record id |

History page on D365 PO |

| Company account |

Legal entity of the document |

|

| Company GLN |

The company’s global location number is shown here. |

|

| Staging to target status |

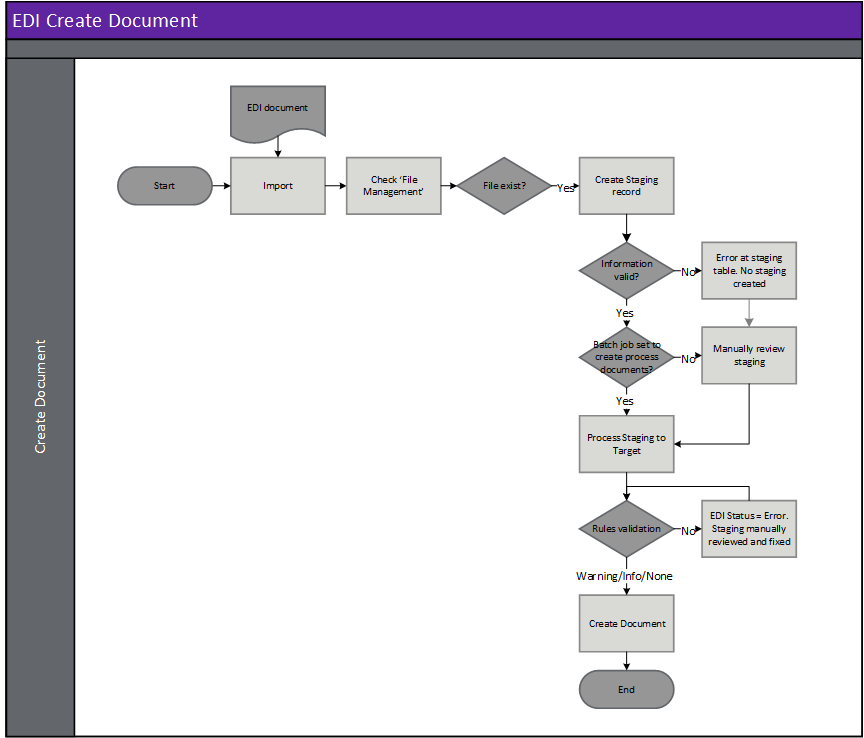

The current status of the staging record. Options include:

• Not Started – The staging record has been successfully processed from the inbound file to the staging table but not processed to target.

• Error – The staging record has been processed from the staging table but no target has yet been created/updated. There are errors with the staging record that needs to be reviewed.

• Completed – The staging record has been succesfully processed and created a D365 purchase order invoice.

• Canceled – The record has been manually canceled and will be excluded from processing. |

|

| Reset status |

|

|

| Reset status profile |

Reset status profile assigned to the file/document. This will default from EDI shared parameters or can be overridden on Trading partner’s incoming and outgoing documents. The profile can also be changed to another profile which will also reset the Reset status attempts to 0 and reset the Reset status date/time |

|

| Reset status date/time |

Next date/time automatic reset status will run |

|

| Reset status attempts |

Number of reset attempts already processed. The reset attempts will stop once this number reaches the End after as per assigned Reset status profile’s Recurrence |

|

| Recurrence |

Recurrence text. Contains standard details of Recurrence, for example:

• Interval (recurrence pattern)

• How many times the period will run (End after)

• From date/time the recurrence will start |

|

| Overview |

|

|

| Invoice |

Vendor’s invoice id for the Purchase invoice record. |

Invoice> Invoice number |

| Document date |

Purchase invoice’s document date |

Invoice > Document date |

| Invoice type |

Determines if the EDI document is an invoice or credit adjustment note. EDI amounts for credit adjustment note will be positive in EDI and will be converted to negative amounts in target credit adjustment note |

|

| EDI document purpose |

The EDI document purpose is shown here. Currently only original invoice supported. This field is just for information. |

|

| Status |

|

|

| Group control number |

Group control number for outbound document. To be used to match inbound functional acknowledgement, where applicable. |

|

| Sent |

Indicates if outbound functional acknowledgement has been sent to the trading partner for the inbound document. |

|

| General FastTab |

|

|

| Purchase invoice |

|

|

| Invoice |

Vendor’s purchase invoice id |

Invoice > Invoice number |

| Invoice reference |

Contains external references to the Invoice that are important to the processing and use of the Invoice. |

Invoice > Document number |

| Header note |

Contains any free form text pertinent to the entire invoice or to the Invoice document itself |

|

| Tax point date |

In xCBL standard. In most cases, if a business is invoice accounting for VAT, the tax point is the same date as the VAT invoice, and if a business is cash accounting for VAT, the tax point is the date when the money is received. There are exceptions though, for example if a business supplies goods more than 14 days before it issues a VAT invoice for those goods, the tax point is the day the goods were supplied. |

|

| Details |

|

|

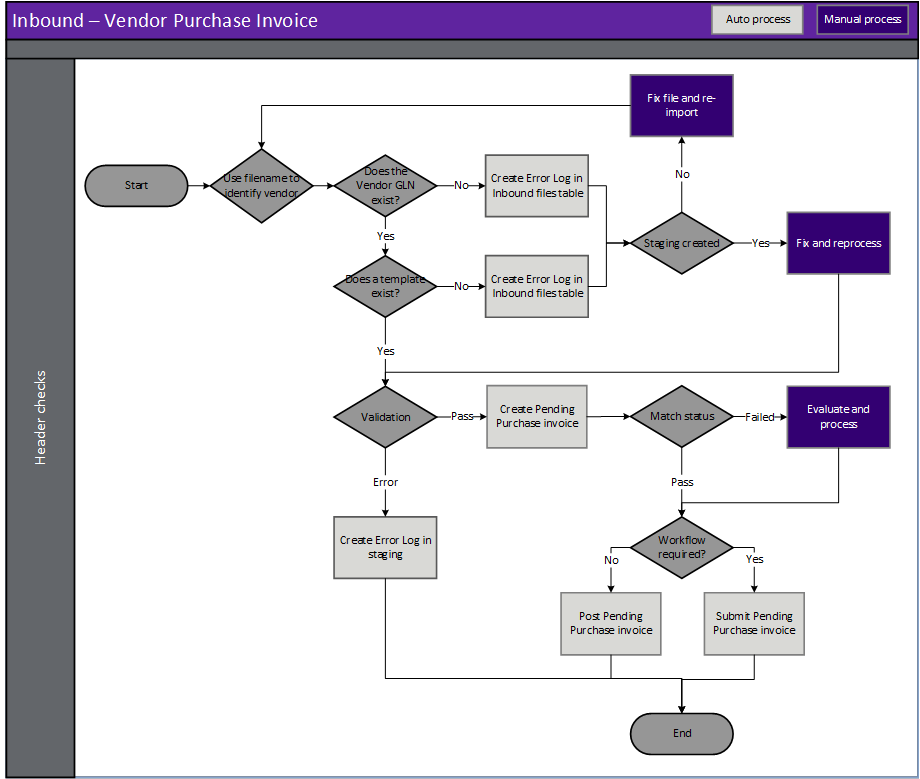

| Vendor account |

Vendor account for the staging record |

|

| Vendor name |

Vendor name |

|

| Trading partner GLN |

The vendor’s global location number is shown here. |

|

| Company GLN |

The company’s global location number is shown here. |

|

| Buyer group |

The Purchase Order’s Buyer group is shown here. |

|

| Buyer name |

Buyer name |

|

| Buyer email |

Buyer email |

|

| Buyer phone |

Buyer phone |

|

| Company phone |

Company phone |

|

| Company name |

Company name |

|

| Tax registration number |

Company tax registration number |

|

| Vendor invoicing |

|

|

| Vendor name |

Vendor name |

|

| Vendor primary street number |

Vendor primary address - street number |

|

| Vendor primary street |

Vendor primary address - street |

|

| Vendor primary city |

Vendor primary address - city |

|

| Vendor primary county |

Vendor primary address - county |

|

| Vendor primary state |

Vendor primary address - state |

|

| Vendor primary ZIP/postal code |

Vendor primary address - ZIP/postal code |

|

| Vendor primary country/region |

Vendor primary address – country/region |

|

| Customer invoicing |

|

|

| Bill to |

Our account number as loaded on Vendor’s Invoice account |

|

| Name |

Bill to - Name |

|

| Name or description |

Bill to - Invoice address name |

|

| Street number |

Bill to - Street number |

|

| Street |

Bill to - Street |

|

| City |

Bill to - City |

|

| County |

Bill to - County |

|

| State |

Bill to - State |

|

| ZIP/postal code |

Bill to - ZIP/postal code |

|

| Country/region |

Bill to - Country/region |

|

| Version |

|

|

| Created date and time |

The date and time the selected record was created in the staging table. |

|

| Delivery |

|

|

| Delivery name |

Ship to - Name |

|

| Our account number (Ship to) |

Our account number as loaded on Vendor’s Order account |

|

| Store code |

Ship to - Store code |

|

| Street number |

Ship to - Street number |

|

| Street |

Ship to - Street |

|

| City |

Ship to - City |

|

| County |

Ship to - County |

|

| State |

Ship to - State |

|

| ZIP/postal code |

Ship to - ZIP/postal code |

|

| Country/region |

Ship to - Country/region |

|

| Attention information |

Attention information |

|

| Miscellaneous |

|

|

| Misc indicator |

Code which indicates an allowance or charge for the service specified. Mapped value setup in Misc charge/allowance indicator.

Mandatory if Misc amount, Misc quantity or Misc percent populated.

If the indicator indicates it is an Allowance the EDI values provided will be made negative since all EDI values would be positive. |

Invoice > Affects sign of Invoice charges value |

| EDI charges code |

Code identifying the service, promotion, allowance, or charge. Mapped value setup in Charges code. |

Charges code, if Charges document setting As per EDI document is set to Yes |

| Misc quantity |

Specifies the allowance or charge where the calculation is based on quantity |

Charges Value = sum (Invoice quantity for all invoice lines) * Misc quantity |

| Misc percent |

Specifies the allowance or charge based on a percentage. |

Charges value = Invoice subtotal amount * Misc percent / 100 |

| Misc method of handling |

Specifies how the allowance or charge will be settled. |

If Add to invoice is set to Yes: the charge will be added to the invoice |

| Misc treatment |

Additional information on misc. pricing. In xCBL specifies if the basis of the line item-level Allowance or Charge amounts are net or gross |

|

| Misc description |

Describes the allowance or charge using references or free text. |

|

| Totals |

Amounts dependent on document setting ‘Prices include sales tax’ |

|

| Subtotal amount |

Subtotal of all purchase order lines |

|

| Misc amount |

Purchase order header Misc charge/allowance amount |

Invoice > Charges Value |

| Misc tax amount |

Tax amount for the Misc charge or allowance |

|

| Tax amount |

Total Tax amount |

Invoice > Sales tax |

| Round-off |

Round-off |

|

| Total amount |

Total amount |

Invoice > Invoice amount |

| Payment |

|

|

| Currency |

Purchase invoice currency |

Converted to PO currency |

| Target currency |

Target currency of the rate of exchange. This is the currency from which the monetary value is to be converted to. |

|

| Reference currency |

Holds the reference currency of the rate of exchange. This is the currency from which the monetary value is to be converted from. |

|

| Exchange rate |

Holds the value that the reference currency is to be multiplied by to convert it to the target currency.

If Invoice currency doesn’t equal to PO currency this will be used to convert to PO currency if document setting ‘Use vendor exchange rate’ = Yes |

Invoice’s exchange rate if document setting Use vendor exchange rate is set to Yes |

| Exchange rate date |

Date of above exchange rate |

|

| Terms code |

Payment terms. Mapped value setup in Payment terms type group. |

|

| Terms net days |

Payment terms net due days |

|

| Invoice due date |

Date invoice is due for payment. Only applicable to xCBL. Terms net days used for X12 and EDIFACT |

If document setting Due date is set to Vendor due date, used for Invoice’s due date |

| Cash discount |

Settlement discount percentage |

|

| Days |

Settlement days |

|

| Discount amount |

Settlement discount amount if paid within settlement days |

|

| Payment status |

Code specifying the actual status of a payment, xCBL examples: PaidInFull, PartPaid, NotPaid. For information only |

|

| Payment reference |

Reference number assigned to a payment |

If Invoice reference is blank, use Payment reference as Document number |

| Prepaid amount |

Total prepaid amount for the invoice |

|

| Total amount payable |

Total amount to be paid for the invoice |

|